On November 15, 2021, the President of the United States (Biden) signed the largest infrastructure spending bill of all time, $226 billion earmarked for projects that require large amounts of copper.

According to a reputable copper company (whose name has not been disclosed), a large multinational copper company is exploring an excellent spot of new copper discoveries and has advised that if you want a chance to profit from Consider Biden’s huge infrastructure costs, consider copper companies.

Copper is up 79% from February 2020 to February 2022… and many experts believe this is just the beginning of a massive uptrend for this shiny metal.

It seems that copper, this precious mineral, is badly needed to help the green revolution of clean energy, and Joe Biden has recently given a big boost to copper and its investors, because The $226 billion Infrastructure and Jobs Investment Support Act of 2021, like the shopping list for copper-based projects, is seen as a government gift card.

Biden and in general all politicians hoping to fulfill their promises for a clean energy future have no other way than to invest hundreds of billions of dollars in copper.

Let’s examine this simple fact:

Without copper… without the future of clean energy!

By now, you may have heard that lithium is one of the secret ingredients to boost the green revolution. This sentence may be true but…

While many green experts and big electric cars like Elon Musk (in order to increase his corporate value) have zeroed in on the need for more lithium to make the batteries needed to power electric cars with clean energy, meaning There is an overlooked green commodity that is quietly increasing, and this commodity is copper.

In general, it can be said: the transition to electric cars will not be possible without new sources of copper, that is why it is necessary to make only one EV device.

Electric Vehicle is an abbreviation of an electric vehicle. Electric cars are cars that work partially or completely with electric power.) Large amounts of copper are needed.

You see, in a typical gas car, depending on the size of the engine, it takes 18 to 49 pounds of copper to produce that car. But in just one EV, 183 pounds of copper is needed to make one electric motor! This means that 4 to 10 times more copper is needed, so as the demand for electric cars increases in the next decade, the demand for copper is expected to increase as well.

Electric cars are expected to increase by 14 times by 2030, from 8.1 million electric cars on the road in 2010 to more than 25 million electric cars by 2030. In this case, more than 23 million new electric cars are being produced.

By issuing a decree to convert the entire federal transportation fleet (645,000 vehicles) to electric vehicles by 2035, President Biden has made a special contribution to this issue.

More and more automakers, including General Motors and Volkswagen, Lexus and Mercedes-Benz, are committing to producing only electric vehicles by 2035, even oil and gas giant BP predicts 100 million vehicles by 2035. Electricity is moving on the roads of the world.

If this prediction is correct, 1.8 million tons of new copper will be needed just to keep pace with the unstoppable EV revolution. This demand is so strong that even the New York Times asks…

“How long will electric cars rule the roads?”

And the honest answer is that if new sources of copper can be found, it won’t be long…

But it is not only electric cars that need large amounts of copper. Electric transit buses, also known as Zero Emission Buses (ZEBs), require huge resources of copper, and the demand for ZEBs has skyrocketed.

Currently, in the United States alone, there are approximately 1,300 public ZEBs on the streets, which is only 2% of public transit buses.

Now, the US government wants all buses to be electrified by 2035, including school buses, which means 63,700 new ZEBs are needed.

But just one electric bus engine requires 814 pounds of copper, which means more than 5,23,000 tons of copper must be mined – just for electric buses!

And while this growing demand for EVs could be big enough to potentially drive copper prices into big double- and triple-digit gains*, what most investors don’t know is that…

The unique demand for copper goes beyond electric cars.

Unlike lithium, which mainly focuses on clean batteries, the importance of copper for the green revolution goes far beyond the manufacture of electric motors. In fact, copper plays an important role in

Protection of the electricity network is to secure the country’s infrastructure and people.

Nothing is more essential to people than the electricity we use through our national power grid. Electricity from power plants is distributed directly to our homes through a complex network of 600,000 miles of transmission lines, and it is interesting to note that copper is needed in almost all phases of electricity infrastructure, including generation, transportation, distribution, and consumption. Is.

But the FBI warns that cyber attacks have become a major threat to the US power grid.

According to a recent Senate report released in 2021, the US power grid is “vulnerable” to catastrophic blackouts launched by Russia, China, Iran and North Korea.

The impact on hospitals, police, first responders, banks, gas stations, military bases and families can be… and I quote (catastrophic).

It is necessary to explain that: this is not a science fiction story and such cyber attacks have already happened.

In 2015, a Russian cyber attack on Ukraine knocked out power for 225,000 people for hours, Russia attacked Ukraine again in 2016, leading to more blackouts.

Russian hackers attacked Saudi Arabia in 2017 and shut down the safety systems used to prevent an explosion in a petrochemical plant and see what happened today with Russia’s attack on Ukraine.

Intelligence sources believe that these are tests for a massive attack against America.

According to Jennifer Granholm, Minister of Energy:

“The United States faces a documented and growing cyber threat from malicious actors seeking to disrupt the electricity Americans need to power our homes and businesses.”

This threat to the electric grid is one of the reasons why the Biden administration is committed to improving the US electric infrastructure. Their plan is to build thousands of miles of new, flexible transmission lines to not only deliver cleaner, reliable energy at a lower cost, but also help protect the grid from potential cyber attacks.

The US electricity industry is currently investing more than $100 billion per year in smarter energy infrastructure to upgrade and secure its grid.

In addition to the fact that, unlike other metals, copper does not rust, copper remains a key material of the traditional grid because of its superior conductivity, durability and reliability, which increases energy efficiency and security.

Copper is also an ideal metal for moving power lines underground due to its high conductivity, strength and resistance to corrosion. This means lower maintenance costs, longer life and protection from the weather, and this is another vital reason why we should put stock charts of giant copper companies on our investment charts today, and copper is not only the key. Protecting our national grid is also a key element in the world’s transition to clean, renewable energies, such as cellular and solar panels.

While the nation’s electricity is connected by 600,000 circuit miles of transmission lines—all of which require copper—small local solar and wind systems are cropping up around the world to bring power to universities, hospitals and barracks, apartments, and more. and bring… If these are known as “microgrids” and can be isolated from the national grid and operate independently, this flexibility can reduce the risk of widespread power outages in the event of an attack or natural disaster.

This transition to local renewable energies will make our electricity source more powerful, safer and more efficient, and new sources of copper must be found to continue the green revolution.

Let’s do more concrete calculations. for example…

Today, 114,000 megawatts are produced by solar energy in the United States, which requires 5.5 tons of copper to produce one megawatt, so 627,000 tons of copper are needed.

And one wind turbine alone contains 7.4 tons of copper, and there are about 67,000 wind turbines in operation in the United States today, representing 315,000 tons of copper.

The International Energy Agency (IEA) reports that the world will add 290 GW of renewable electricity in 2021. That’s about 5.1 million tons of copper, which was used last year alone to boost solar and wind power generation, and according to the International Energy Agency’s 2021 Renewable Energy Report, by 2026, global renewable electricity is expected to account for 60 percent of Increase the current level.

If these predictions for renewables hold true, vast supplies of copper must be found to keep pace with the world’s unstoppable transition to clean, renewable energies.

Fortunately, copper is still responsible for the energy supply of traditional renewable energy grid systems such as wind, solar and electric vehicles.

Make no mistake that…

Copper is the key to creating a clean energy future.

So without new copper reserves, the green revolution may come to a shocking end…or green energy may become too expensive and only available to the super rich.

President Biden is spending hundreds of billions of dollars to finance the Green Revolution, and that’s exactly what he did with his massive $1.2 trillion infrastructure bill.

So if you’re looking for a locked-in bullish trend backed by massive US government spending power, you can’t do better than the copper mining stocks you “back” (all the copper giants in the world) and I mean it. I introduce.

Clean energy is the next big investment trend…and copper is king!

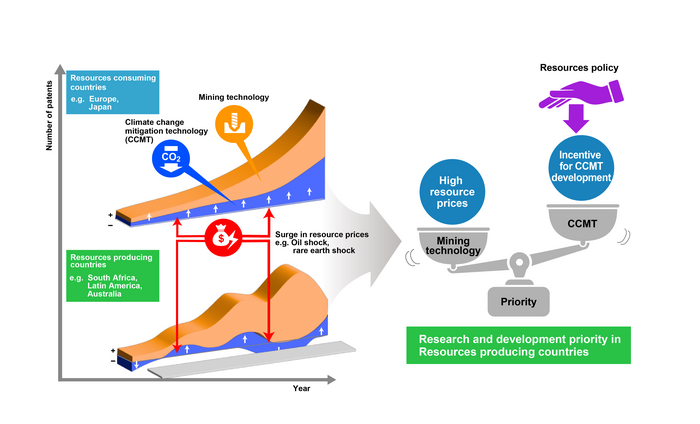

This clean energy process is irreversible with copper, a vital metal required for smooth transition. Over the past decade, copper demand has been steadily increasing from green initiatives such as EV adoption, new renewable energy sources, and green-focused infrastructure spending. But despite strong demand, supply is lagging significantly, and the situation is set to worsen with analysts predicting copper demand could increase by 350% by 2050.

No wonder Biden spent the $226 billion copper windfall on future infrastructure.

Take a look:

1- 65 billion dollars to rebuild the power grid, including the construction of thousands of miles of new power lines and the expansion of renewable energies

2- $39 billion to modernize public transportation, with an emphasis on zero-emission vehicles

3- 65 billion dollar investment to improve the country’s broadband infrastructure

4- 17 billion dollar port infrastructure

5- $25 billion in airports to promote electrification and other low-carbon technologies

6- 5.7 billion dollars for non-polluting and low-polluting buses and ships, with the aim of delivering thousands of electric school buses to regions across the country.

7- 5.7 billion dollars to build a national network of chargers for plug-in electric cars

Total: $226 billion spent, all for copper.

Each of these cost allocations I just listed requires copper, and it’s no wonder that many analysts believe that if no new copper mines are found, a potentially catastrophic copper shortage could reach 10 million tons.

Additionally, an additional $110 billion from this infrastructure bill will go toward building roads and bridges, which require large amounts of copper.

It is worth mentioning that copper is the metal of choice in the construction of equipment, heating and cooling systems, mobile phone and computer microprocessors, internet services, cable wiring, residential and commercial constructions. Copper is also used in the construction of airplanes, trains, transformers, generators, oil platforms, coastal power plants and other things.

Copper even has antimicrobial properties and copper handles are common in public buildings, which are considered essential goods during an epidemic.

This is the reason why I recommend that you act quickly and invest in the shares of copper companies and huge copper mines.

Truly, I have never seen such an amazing opportunity for everyday investors to take advantage of – (the world’s irreversible commitment to clean energy in the next decade).

Robert Friedland, a copper miner who is known as a billionaire, excitedly stated in one of his speeches that:

“If the world is to successfully transition to clean energy and green transportation, then everything is copper, copper, copper, copper, copper, copper!”

If we now follow the clean energy trend with Biden and Congress committing hundreds of billions of dollars in infrastructure contracts that require massive amounts of copper… So, we could see the start of a brutal copper climb like we’ve never seen before.

Question :

Don’t you want to miss the opportunity to take a look at huge copper companies with these factors coming together now?

While this is all good news for investors looking to invest in copper, there is another factor at play that could make copper giants particularly attractive.

Within a decade, the world could face a severe shortage of what is arguably the most vital metal for global economies, copper.

Bloomberg News March 19, 2021

The 800-pound gorilla that devours the world’s copper.

In 2020, the world consumed 9.26 million tons of copper. (The latest data) and it is not surprising, but… China consumes 54% of the world’s copper, while the consumption of Europe and North America in total is not even half of China’s consumption.

It can simply be said that China dominates copper as a consumer.

The noteworthy point is that China only extracts 8% of the world’s copper tonnage, and it is questionable that:

Where does China get all its copper from?

According to the report of the American Enterprise Institute, between 2005 and 2020, China has spent more than 56 billion dollars to buy copper assets (mines) abroad.

As you can see in the chart, Africa’s natural resources are being plundered by China, but did you notice? China has spent almost zero to invest in copper mines in North America? (as of the writing of this article)

Forbes magazine even calls China’s copper fork the “800-pound gorilla.”

China may currently consume 54% of the world’s copper resources, but I expect China’s thirst for copper to grow—driven by the needs of its 1.4 billion people—minus the rest of the world.

And that’s why I’m excited about huge copper companies all over the world, especially those that are in the sweet spot of potential new copper discoveries.

There aren’t many copper giants on China’s tracking monitor right now, so it might be a prudent investment for every single person on the planet looking to take advantage of massive government spending on new infrastructure projects… sure. It increases the demand for copper.

What could be America’s solution to block China’s greed for copper?

As China devours more than 50 percent of the world’s copper assets, the United States is quietly following its northern neighbor, including Canada and Latin America and Middle Eastern countries, to meet its insatiable and growing demand for copper.

This is because copper mines and minerals are found all over Canada, but today only four provinces in Canada (out of a total of 12 provinces) produce copper. Canada has the 10th place in copper production in the world.

In 2020, Canadian mines produced 475,898 tons of copper, more than half of which (256,688 tons) originated in British Columbia. The value of Canadian copper exports reached 7.3 billion dollars in 2020.

As you can see, British Columbia is 10 times more than Canada’s least productive provinces. So it’s no surprise that copper companies are expanding their exploration efforts in this location.

Are we in a new “golden age” for copper?

Despite its impressive record of copper production, British Columbia is one of the most unexplored mining regions in Canada.

Perhaps that’s why Mining.com wonders if a new golden age for copper is coming to British Columbia thanks to the global energy transition.

Greg Hart, Director of Mineral Resources Research at the University of British Columbia says:

“All of this requires a lot more copper, and our feeling is that British Columbia is probably as ready as any company on the planet to take advantage of this opportunity.”

Today, copper produces 28% of the net income of British Columbia’s mining industry, second only to coal.

“Confidence in the global mining industry has returned and is evident in many industries in British Columbia…the mining sector is seen as a key player in the world’s transition to a low-carbon economy.”

PricewaterhouseCooper

In the rush to get gold, miners were literally running over copper to get to it, and for many years, the price of copper was so low that it was almost not worth mining.

For several decades, copper is often mined together with other metals, including gold. In short, I’ll explain why this gold/copper mining connection is a huge boost for the giants and their investors, but first let me explain what could happen to propel copper prices over the next decade.

Considering that copper is an important mineral in the new green future leading to increased demand, the only question many experts are asking is…

How high can copper go?

As new sources of copper are desperately needed, copper exploration in Canada and around the world is increasing, and the optimistic expectation of an upward trend in copper prices is steadily driving prices higher. As a result, copper demand continues to grow to new historical levels. The price of copper in May 2021 reached its highest level of 10,000 dollars per ton in the last 10 years.

Now the good news…

The predictions for copper are extremely bullish!

Goldman Sachs predicts that copper will be worth $15,000 per ton by 2025, a 50% increase from current prices. Bank of America boldly predicts that the price of copper will reach $20,000 per ton by 2025 due to the increase in supply and demand deficit, which is double the current prices.

And David Neuhauser, founder and CEO of US hedge fund Livemore Partners, said: “I think copper looks fantastic for the next five to 10 years with the potential of $20,000 per metric ton.”

Here’s an investor trick I learned from my teacher… When the big hedge funds and investment banks see small-cap copper exploration companies with good returns, we as regular investors should pay more attention and As copper (and other minerals) enter what many say is a “supercycle” of growth, now may be a good time for us to get behind the wheel by investing in copper exploration and mining companies. Be ready to enter the market with several percentages of profit.

Now is the time to focus on copper

I can understand why, regardless of the round-the-clock drumbeat of the covid-19 pandemic, why copper has been in the spotlight with so many other investment news stories in the past year (such as … Bitcoin’s crazy rally.. .vaccine stocks skyrocketing…fear of rising inflation), has flown on the charts….

But now it’s time to turn our attention to copper… not only for the many reasons I’ve already told you, but for the simple fact that…

As a result of the growth of green demand, copper companies have performed well recently. Let’s take a look at the stock returns of several multinational copper companies last year…

Glencore (OTC:GLCNF), a top copper producer, has seen gains over the past 12 months

23.51% of its share price.

Freeport-McMoRan (NYSE:FCX) saw its stock rise 40% in January 2022.

First Quantum Minerals (OTC:FQVLF), a Canadian company, saw its share price jump 37% from February 2021 to February 2022.

And this is the fact that we may be behind the caravan…

Small copper exploration companies operating in British Columbia have performed very well, and here are just a few returns recorded in the past year (as of this writing):

- CopAur Minerals (TSXV:CPAU) 617%

- Pacific Ridge Exploration (TSVC:PEX) 570%

- Copper Mountain Mining (TSX:CMMC) 96%

- Teck Resources (TSX:TECK) 54%

- In general, it seems that copper may go through a significant upward trend in the next few years.

Now of course, as any honest investment analyst will tell you…past performance is no indication of future results and nothing in investing is guaranteed.

But copper seems to be taking advantage of the strong winds from the world’s move towards a clean energy and low-carbon economy.

I believe there is no turning back from this trend. That’s why I think you should consider copper, one of the minerals needed to create a clean future.

And today, I have shared with you my opinion on large and small copper companies, why not to investigate one or more real copper exploration companies that are on the verge of significant copper discoveries in the future – far from the understanding of greedy and predatory China. China, in what I have called the sweetest copper spot in the world, right in British Columbia and in the Middle East, is it necessary and necessary?

Don’t miss this historic opportunity to invest in today’s “it” trend with copper companies.

Today, we are experiencing an energy shift of epic proportions. Almost every country is working towards a clean, carbon-free future.

The US government is spending hundreds of billions of taxpayer dollars to accelerate the transition to green energy. According to the Wall Street Journal, $2 trillion has poured into green investment funds to move away from fossil fuels. More than 5 billion dollars of bonds and loans are issued every day to finance green projects. America’s two largest banks have pledged $4 trillion to help transition to green energy over the next decade. The International Energy Agency calls for $5 trillion a year in energy projects to achieve net zero emissions goals.

Green investing now looks less like the interest of socially conscious investors and more like a sustainable gold rush.

Wall Street Journal, May 22, 2021

Power transmission is like the “IT” trend of the 21st century. Early investors in the green revolution can probably be the green millionaires of tomorrow! And copper is in the center of green investment.

Find out more about Copper Enterprises, a copper exploration and development company that is exploring the pure copper zone.

Simply visit their website to learn more about the company and what they do, you can speak to one of their investor representatives or leave your email address to be the first to receive future news. he does. You can also present this investment report to your broker and to your friends.

Investing in copper companies has the potential to receive high profits, but it also has a higher risk. And past performance is no guarantee of future results.

But with this extreme caution, I believe my analysis of the future of copper is excellent.

Thanks to Dr. Masih Rezvani and Iranzayeat magazine as the source of this article.

#copper #copperprice #copperanalysis #gainanalysis #china #america #coppercompanies